How To Budget Money: For Some Peace of Mind

I am not going to try to sugar coat this… learning how to budget money is HARD! I wonder if the reason it is so hard for most of us is that it’s like housework. How many of us can relate to this: you set aside a day to do the laundry, fold and put away the clothes, or clean the house or even take care of the science experiments growing in the kitchen. You get it done, sigh a sigh of relief and move on only to have to clean again… and again…. And AGAIN!!!!! IT NEVER ENDS!!!

Yep, it can feel like insanity because I think we are all hoping that if we take care of it we can not worry about it for a long while.

Okay don’t obsess… moving on.

That’s my theory, keeping track of our money isn’t what we would define as fun but it is necessary to keep our finances in order much like keeping up with our kitchen helps us feel better and be more efficient for meals.

Or having clean clothes that are nicely folded and where they are supposed to be, gives us a weird sense of satisfaction that everything in the world is as it should be. (Do you think I think of house chores too much??)

This blog post may contains affiliate links, read full affiliate disclosure here.

So let’s start with the basics.

What is a budget? What does it do?

In simplest terms, a budget is a spending plan for your income where you are sending your money (expenses). Budgets are like guardrails, to protect us against ourselves. I will admit it, I can get carried away; books, shoes, clothes shopping, essential oils, movies, food!

Oh, I love food!!!

Establishing a budget allows us to know what we have to spend on those items we really want while giving us the peace of mind that our bills will be paid and we will live to fight another day.

Your budget can accomplish a number of goals: get out of debt and stay out of debt, plan for big purchases or emergencies around your regular expenses, and achieve personal life goals. When we talk about life goals that could mean a variety of things:

- Owning a house or a piece of land

- Starting a business such as a restaurant or marketing firm

- College

- Retire early

- Travel

The list could go on. The goal is not to become a slave to money but to get money to work for you and allow you some freedom to enjoy life, a budget is what will to help you do that.

Budgeting Myths

Myth #1– If I make more money then all my problems will go away!

- Yea… no… More often money problems come from not having a spending plan for your money. Money is probably slipping through the “cracks” eating out too much, impulse spending then you don’t have the money you need for the necessities or even emergencies.

Myth #2- Budgeting is only for people who are trying to get out of a massive amount of debt.

- NO!!!! I mean yes, it certainly helps get you out of debt but there are many great reasons to have a budget other than that. You will probably get tired of hearing this but a budget is a spending plan for your income. If you have any goals or dreams for your future, a budget can help make those hopes a reality.

Myth #3- I am balancing my checkbook. That’s as good as budgeting, right?

- While balancing your checkbook is great, if anyone really does that anymore, balancing your checkbook just tells you what your spending behavior was for the month. It’s more of an afterthought. A budget is a forethought, where do you need your money to go to achieve your goal even if it’s just to not go into the red (negative in your account).

Myth #4- There is a gold standard household budget.

- Sometimes I think we would LOVE to have a one size fits all solution. Hoping there is less work involved if we find the “right budget.” The truth is a successful budget is a living, ever-changing document and it will look different person to person and family to family. Even over time, your budget will change to accommodate changes in your life.

Why would you want a budget?

We have somewhat touched on this already but the why will depend on what you want out of life. If you are wanting to travel and stay out of debt in the process, a budget can help. What if you are a planner, you want some cushion for emergencies and unexpected life changes, a budget can help you account for that. Want to retire early? Guess what… Yes, a budget can help you get started.

If you have ANY goals for your life, a budget can help you make your way to accomplishing them.

“In the absence of clearly defined goals, we are forced to concentrate on activity and ultimately enslaved by it.”

(Harris, Coonradt, & Nelson, 2001)

Where to Start

I wish I could say that I have a fun way to get started… I don’t. So let’s take the first step.

Research

You need to do some research… on yourself. Gather up your financial documents and bills such as:

- Utility bills

- Paystubs

- Credit card statements

- Bank statements

- Receipts

- Any investments

- Mortgage and auto loan information

You might ask, “why?” Why would I torture myself, I don’t want to know how bad it is.

I know, but in order to create a successful budget, you have to pin down where your money is going. Going through the documents you have (if you have them) can give you a leg up because you can take that data and place them in categories; groceries, eating out, personal necessities, etc. (There are categories further down the post if you are stuck on what to label your categories). This can tell you where your money has been going for the past few months.

Track, Track, TRACK!

In order for a budget to work for you, you need constant data coming in. From here on in, you need to track your expenses and place them in your categories as you go.

You can do this on paper or electronically, we talk about different apps available to help later on. Right now, if you are starting from scratch, you just need the “raw data” of your spending habits. You will be amazed at the opportunities that can open up if you give yourself ALL the information instead of just partial or part of the picture.

Funny huh? You would think that you would already know what is going on since YOU are the one spending the money. However, you will be surprised at how many “cracks” your money is sneaking out of that you just weren’t mindful of until you started paying attention.

Let me be frank, this is a lifestyle change and those kinds of changes are hard. You have to give yourself time to implement these changes into your life. And record your expenses every day… let me repeat that…

EVERY

DAY

Take a little time at the end of the day to make sure that all of your expenses are written down as well as your income. Not only the money coming in and going out but where is it going? Is it shoe shopping or eating out? Perhaps going out with friends or maybe you are just covering the basics and trying to claw your way out of debt. No matter where your money is going, write it down and say what the expenditure was for. Trust me, you will forget, I do it all the time. Do yourself a favor, write what category the money is going right then, it only takes a minute or two.

Tracking Worksheet

Here is a simple tracking spreadsheet you can use in keeping track. There are three worksheets: Income & Essential Expenses, Nonessential Expenses, and Tracking Analysis. There isn’t a hard and fast rule for why certain expenses ended up on essential and nonessential. They just needed to be divided up.

It is already formulated, all of your income and expense records will auto-populate into your “Tracking Analysis” page. This Excel spreadsheet is for one month at a time. You are welcome to make a copy of this spreadsheet and edit it as you see fit. Once you complete a month either print it off or keep it on your computer and start a new spreadsheet for the next month. What is important is to track every penny.

One more note: give yourself some time to make this a habit before you move on. Just track for a week or two. Better yet, track for a whole month. We always hear that it takes 21 days to set a habit, to make it automatic, so give yourself that time to make this process effortless. The goal is to be able to track your money completely on autopilot.

Wants vs needs then trim

Once you start tracking your expenses you will likely start to see some patterns. Now comes the hard part, for me anyway, we need to determine if we are spending our money on too many “wants” that we can do without so we can better take care of our needs.

Just so we are on the same page, let’s describe needs vs wants.

| Needs List: | Wants List: |

| Electricity/ Water Place to live Food Basic toiletries Clothes | Soda Coffee Eating out Big, fancy house or apartment Brand name clothing or shoes The latest phone or tech |

Sometimes we have to ground ourselves. Do you need those brand new jeans or can you buy jeans at a thrift store?

Don’t worry yourself trying to keep up with everyone around you. Be happy with what you have. Spending more money doesn’t equal more fun, just means you spent more.

If you don’t have the money then don’t buy it.

30 day rule

This is a savings rule that can help you curb impulse spending. When you get the urge to buy new shoes or the must-have video game- hit the pause button! If you already have the item in your hands, just put it back and back away…slowly

Instead go home and write it down:

Wait 30 days, if the urge is still strong then look into buying it. Just don’t use your credit card!! Don’t do it!!!

This helps you practice delayed gratification, give yourself time to see if you can get it for less, wait for it to go on sale, or see if it’s even worth your money.

Trim

Most of us, if not all, have expenses that we can “trim” out. Aim to live on less than what you earn and use the rest to get out of debt or put away into savings. Trust me, it will be painful at first. To make a difference, you have to be willing to make changes or sacrifices. One example, make your lunch instead of eating out. Another avenue is to invest in a crockpot so that you can just throw ingredients in the crockpot, and when you get home…

BAM!

Dinner is done!! It’s like a superpower!!

Aim to live off of 90% of your take-home income, freeing up that 10% for debt repayment and/or savings. This is doable for most, it will take a change in our thinking; how we view money, and our strong desire to have things in our lives.

Budgeting options

So far you have laid out your goals. You have also been tracking, trimming, and finding those cracks. Now you need a game plan for your money. There are several budget templates to base your budget from:

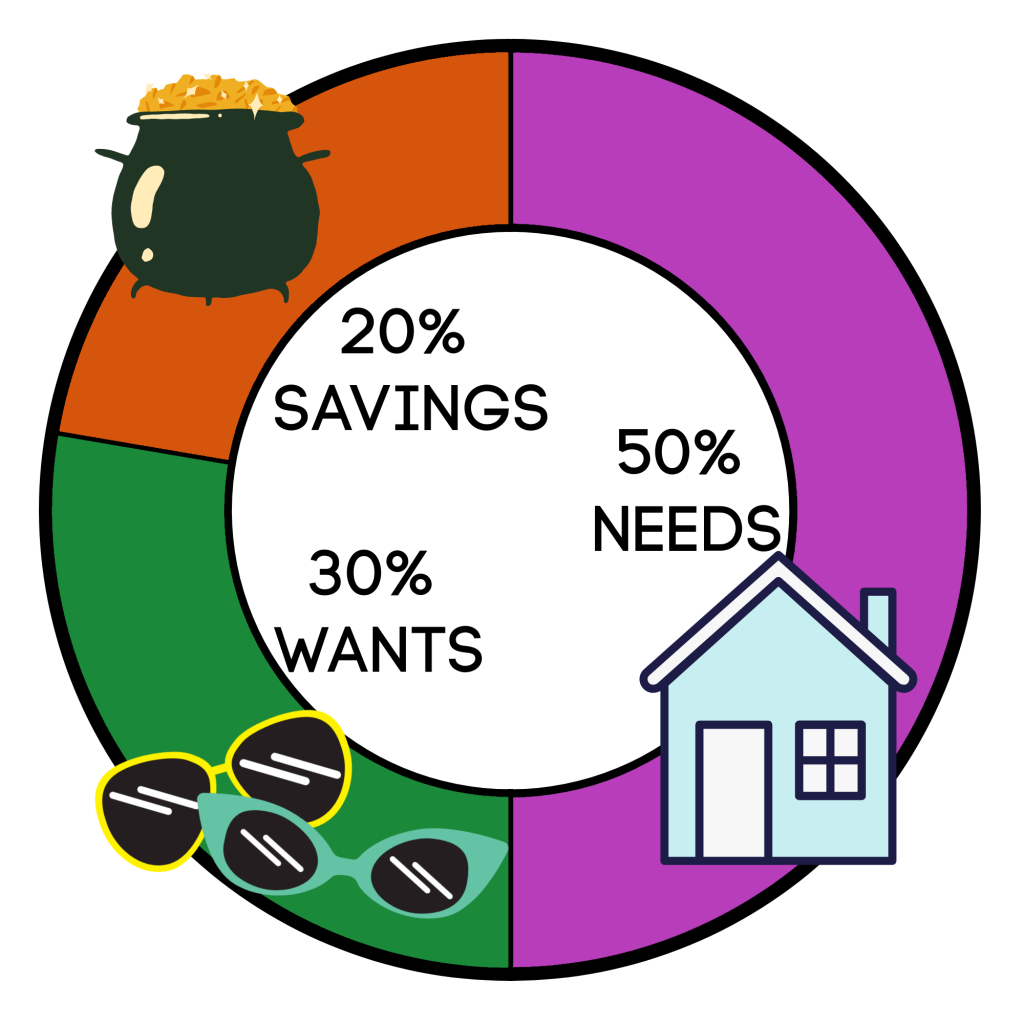

Option #1: The 50/20/30 rule

So the rule for your money:

- 50% of your after-tax income goes to your needs: groceries, utility bills, mortgage or rent, etc.

- 20% to your savings or debt repayment whichever you are working on. This is the portion that is considered you “paying yourself first.”

- 30% to wants: eating out, going out with family or friends, things in your life that are nice to have but aren’t necessarily essential.

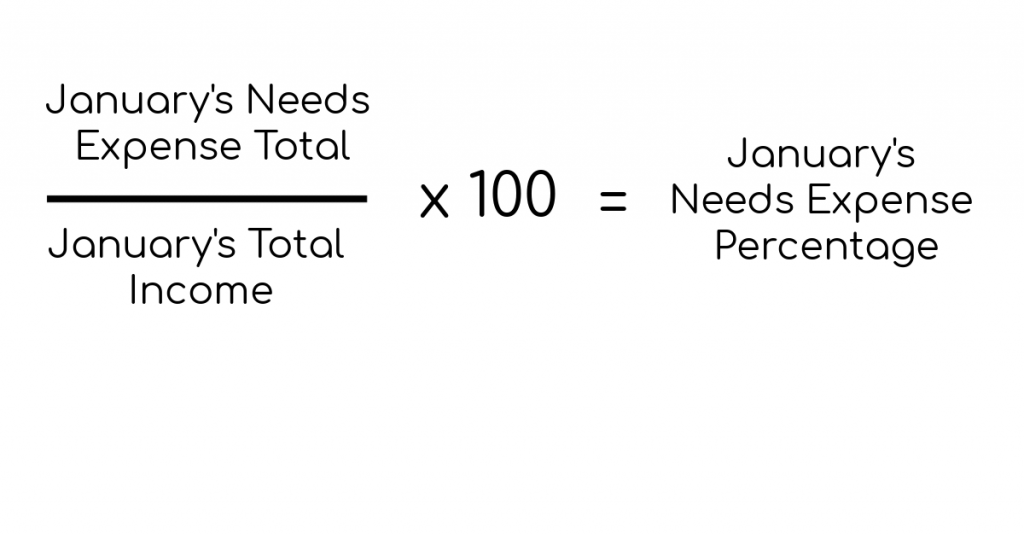

Since you have been tracking your money movement, you should have the raw data you need to figure out what your percentages are. Take a month’s worth of expenses and place those in needs, wants, and savings/debt repayment. Add up each category and divide that by your income for the month and multiply by 100. That’s your percentage.

Are you close or WAY off? When you have those numbers you can take a look at your spending and decide what changes need to be made. This is just one option.

Option #2: Zero-based Budget

Zero-based budgeting is pretty self-explanatory but not necessarily revolutionary. Your goal is to have your income minus expense equal zero, that’s it.

Incoming – outgoing = 0

Use paper or an app, it doesn’t matter. Just record your income, what you anticipate is coming in. Then record the expenses you know are coming. Start with the most important and go from there: food, utilities, mortgage or rent, transportation, and so on and so forth. Have a miscellaneous category for those pesky unforeseeable expenses that have a habit of sneaking up and biting you.

Mentally prepare yourself, you will need to do this every month and as your needs fluctuate or change so too does your budget to accommodate for those fluctuations.

Then take a moment and think of what comes up for the year… Christmas, it is every December there are no surprises there so prepare for it. How much are you wanting to spend? Take that amount, divide by 12, or however many months you have until you need to shop. Account that amount into your monthly budget so the money will be there when you need it and you don’t have to use credit. Birthdays, anniversaries, other holidays, the key is to plan ahead.

The same goes for those expenses that are not monthly but are still consistent shows up (irregular expenses). We are talking car tag renewal, and property tax, use the same strategy as you would holidays and birthdays.

It is important to note that you want your budget to equal zero because you have given every dollar and penny of your income a job whether that’s to needs, investing, saving, whatever. Each cent has a job to accomplish. That doesn’t mean your bank account should say zero.

Don’t freak if you don’t get a zero on your first try. Accept that it might take some time and that’s okay. You are not going to get it perfectly the first time, or even the second or third. Just keep going and if you do, you might be surprised the easier it will get.

Option #3: Dave Ramsey’s Household Budget Percentages

I can honestly say that I struggled with budgeting for years. I didn’t grasp how to apply a budget to my lifestyle. One day, I stumbled across Dave Ramsey’s Household Budget Percentages and it changed how I looked at having a budget.

I was able to digest the numbers so they made sense therefore I could make the necessary changes to plug up holes in my spending as well as tackle the massive medical debt my husband and I have. Long story short: I have rheumatoid arthritis and my husband had Stage 3 Hodgkin’s Lymphoma at age 22, it’s been a bumpy ride.

Pity party over, let’s dive into this: Ramsey gives the following recommendation for household spending.

| Dave Ramsey’s Household Budget Percentages | |

| Giving: 10% | Savings: 10% |

| Food: 10-15% | Utilities: 5-10% |

| Housing: 25% | Transportation: 10% |

| Health: 5-10% | Insurance: 10-25% |

| Fun & Entertainment: 5-10% | Personal Spending: 5-10% |

| Miscellaneous: 5-10% |

Your task is playing with the percentages so that they work for you AND add up to 100%. That way you have a plan for every penny that is coming to you.

Category Definitions

Here is a rundown for the categories listed:

- Giving– this is donations to charities, causes, or perhaps your church.

- Savings– Pretty straight forward, this is the amount you set aside for you and your family. Saving for retirement, emergencies, vacations, etc.

- Food: this category involves both groceries and eating out, everything food-related.

- Housing: This is your rent or mortgage payments. If you own your home then you should account for costs that come with the upkeep of your house and property.

- Utilities: These are your necessities; electricity, gas, water, and trash service. I also lump cell phone and internet services here.

- Transportation: Here we deal with everything related to how we get around whether that be a bike, public transportation, or cars. Repairs, fuel, routine maintenance all fall in this category.

- Health: This is for medical visits, while you may not be able to time when sickness may strike, it is a good idea to put money aside so when medical expenses do spring up you will have money to cover it.

- Insurance: ALL insurance plans fall into this, your life, homeowner’s or renter’s, car, health insurance.

- Entertainment: This is anything you and your family do for fun, this includes Netflix or Disney Plus, gym membership (I don’t know if you call that fun but that goes here too), or fun family outings.

- Mad Money: this is also known as personal spending. Clothes shopping, shoes (!!), haircuts, mani/pedis anyone? Maybe you are into home décor or art, anywho that goes here too.

- Miscellaneous: This is the cushion, I don’t know about you but I always manage to forget something and unfortunately those forgotten items cost money. So the miscellaneous category is there to cover you.

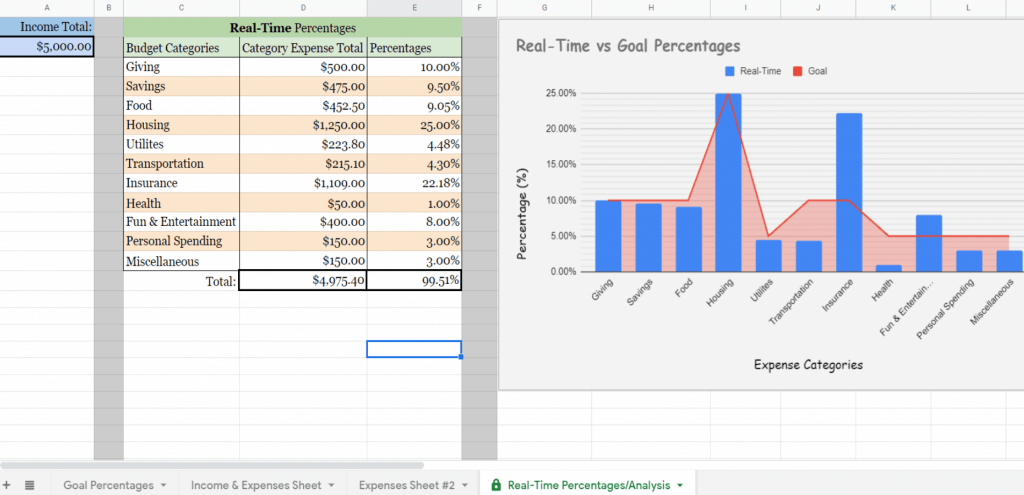

Budget Percentages Worksheet

Now the real work begins. Don’t worry if you like numbers it will be fun! If not… then I am sorry. But I promise it won’t be bad, there are no letters with these numbers like in algebra. So here’s the deal: you need two charts, the first is your projected percentages or desired numbers e.g. 20% savings or low utility percentage of 5%.

Then you move to your actual numbers, pick a month, and divvy up your bills to their respective categories.

I have included this worksheet for you to write your numbers and determine the percentages. Both are useful because your projected percentages chart gives you a sense of where you want to be. While the real-time numbers tell you where you are today, right now.

Budget Percentages Worksheet; instructions are included within the spreadsheet.

Budgeting on a low income

Perhaps you feel discouraged about even attempting to budget because you are just scraping by and you feel you aren’t making enough to bother with a budget. I would implore you to not think that way. My husband and I have been there, it’s depressing. But I promise you, budgeting could very well be the answer you are looking for to help with your situation.

Budgeting might feel like you are confining yourself even further than what your income is doing but it really isn’t doing that. Keeping and maintaining a budget can empower you to pull yourself out, put your money where it will help you, and enjoy life a little more.

First identify the key expenses that are absolutely vital for living: food, shelter, clothing, utilities, transportation. These are often termed the “bare bones” of a budget, and these need to be prioritized and covered each month.

Consider what are your biggest money suckers and brainstorm ways to slash the cost; what can you do without and it might be more than you think. Stay away from credit cards if you have them hide them from yourself. To keep yourself in check invest in the

Cash envelope system

Pull your money out in cash and put in envelopes labeled for what category that money is for: groceries, rent, utility, gas, etc. If the money’s gone, you are done until you get paid. This is a lifesaver so you don’t overdraft your account and tally up those bank fees and you stay away from credit where the interest can sink you before you even realize you are in trouble.

If you have extra cash at the end of the pay period put it all towards debt or savings. There isn’t any instant gratification here but you will be glad at the end when you are out of debt and have an emergency fund cushion.

Next step

If you are living on the bare minimum, you cut everything possible and there is nothing left at the end of the month then it’s time to consider ways to bring in more income. Do you have a talent or skill that is potentially profitable? Odd jobs are another possibility. Also taking advantage of Ebates, Swagbucks, and Ibotta can help send a little more money your way.

Reasons budgeting isn’t working for you

Maybe you have tried to budget in the past and it has been an absolute disaster. Perhaps you put in all the work in creating a budget only to ignore it or avoid it AT ALL COSTS!! Then I hate to say it but the problem isn’t with budgeting. What can make us falter when it comes to our budget?

- You make the process too complicated or think that a budget has to be complicated to work properly.

- The slightest change throws it off, not accounting for irregular expenses or holidays.

- Generosity towards others that wasn’t accounted for (generosity isn’t a bad thing but it will throw a wrench if you don’t plan for it).

- Budgeting on your gross income instead of your take-home pay.

- Unrealistic expectations

- Failing to consider big life changes

- Unable to hold yourself accountable, impulsive spending

If you are ready to jump in then sit yourself down and figure out what is holding you back and how to overcome it. Even ask those you trust and get a different perspective. No rule says you have to figure this out alone, ask for help.

Wrap up

Remember a successful budget is living and ever-changing. You won’t be perfect at it the first time or even several attempts after that. Just keep tracking and tweaking, as you stay diligent in figuring out what works it will become second nature to you.

When you become proficient with your budget consider planning out a month or two in advance and even think about having a back-up budget for if you ever hit hard times.

As much as we hate to admit it, money can either set us free or bind and drown us. Tailoring a budget that is right for you and tracking your expenses allows you to find that money that may have been playing Houdini. Budgeting and tracking put you in control.

“Success happens when preparation meets opportunity. If you steer yourself onto a lifetime course of tracking [your expenses], targeting [your goals], trimming, and training [or educating yourself about money] you will never want for the material things of this world.”

(Harris, Coonradt, & Nelson, 2001)

Related Posts: Secure Your Future: Start a Retirement Fund

References

C. (n.d.). Budgeting With a Low Income, Yes It’s Possible. Retrieved July 24, 2020, from https://mydebtepiphany.com/budgeting-with-a-low-income/

DeNicola, L. (2019, November 04). What Is a Budget? Retrieved July 24, 2020, from https://www.experian.com/blogs/ask-experian/what-is-a-budget/

Ganti, A. (2020, April 07). Budget Definition. Retrieved July 24, 2020, from https://www.investopedia.com/terms/b/budget.asp

Harris, B., Coonradt, C. A., & Nelson, L. (2001). The four laws of debt-free prosperity. Bountiful, UT: Chequemate International.

How to Make a Zero-Based Budget. (2020, March 30). Retrieved July 24, 2020, from https://www.daveramsey.com/blog/how-to-make-a-zero-based-budget

Moore, A., & Bucci, S. R. (n.d.). What a Budget Can Do for You. Retrieved July 24, 2020, from https://www.dummies.com/personal-finance/budgeting/what-a-budget-can-do-for-you/

Ramsey Solutions. (2019, September 13). A Zero-Based Budget: What and Why. Retrieved July 24, 2020, from https://www.daveramsey.com/blog/zero-based-budget-what-why

Roth, J. (2019, May 27). Control impulse spending with the 30-day rule. Retrieved July 24, 2020, from https://www.getrichslowly.org/control-impulse-spending-with-the-30-day-rule/

Schroeder-Gardner, M. (2017, June 28). Do you know the difference between wants and needs? Retrieved July 24, 2020, from https://www.makingsenseofcents.com/2017/06/wants-and-needs.html

Whiteside, E. (2020, April 05). What Is the 50/20/30 Budget Rule? Retrieved July 24, 2020, from https://www.investopedia.com/ask/answers/022916/what-502030-budget-rule.asp